Overtime calculator georgia

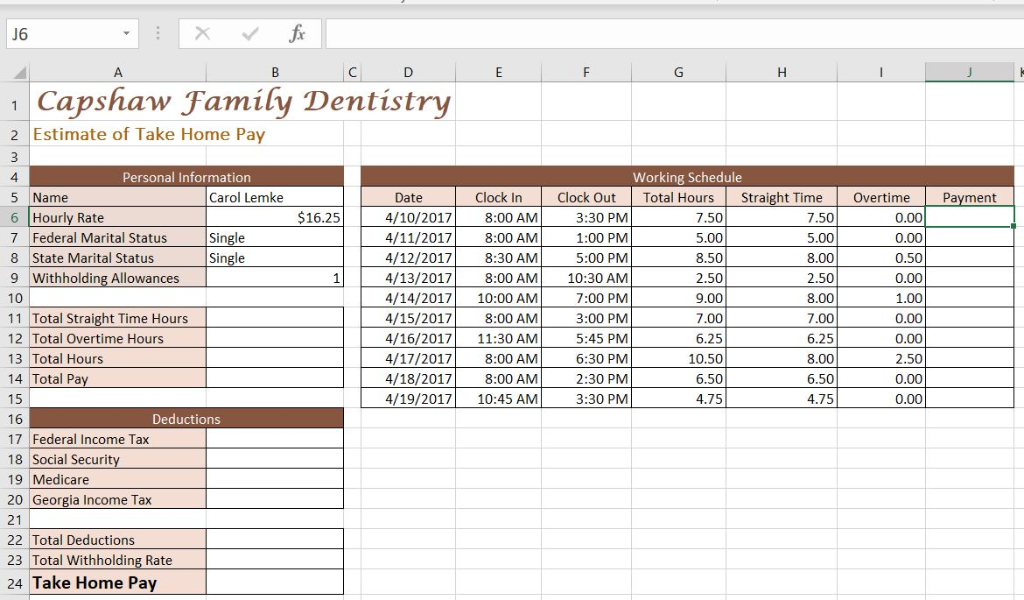

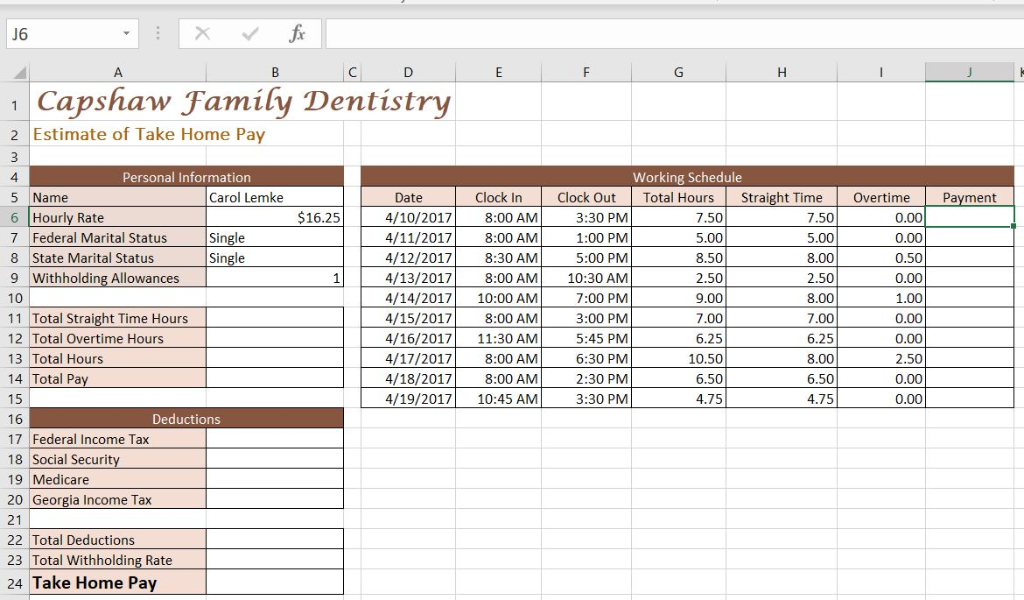

Its set to raise the standard salary to over 35000 annually. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

Overtime Calculator Gpetrium

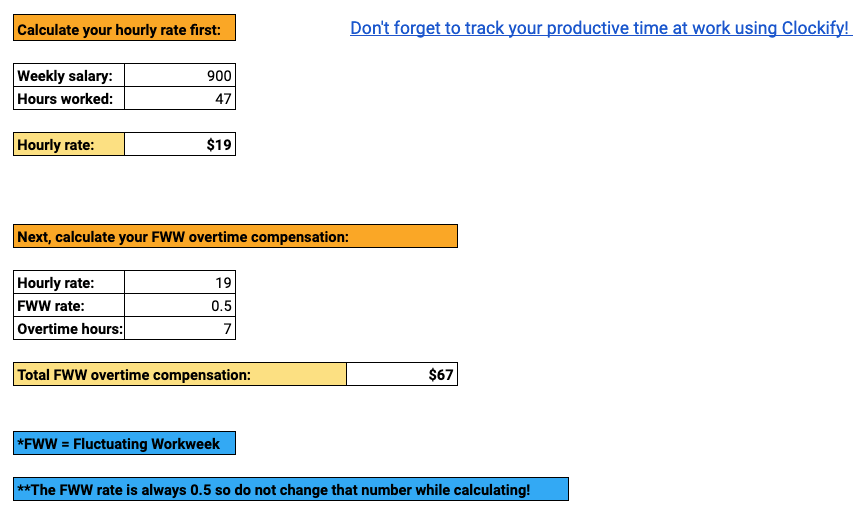

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

. Pay time and a. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

Most workers in Georgia are entitled to overtime pay when they work more than 40 hours per week. Overtime pay per period. Fair Labor Standards Act FLSA of 1938.

Therefore Georgias overtime minimum wage is. The algorithm behind this overtime calculator is based on these formulas. If you are an hourly employee you should receive overtime compensation equal to 15 times your.

In certain circumstances however there are exceptions. For 2022 the minimum wage in Georgia is 725 per hour. DOL is increasing the.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements. A RHPR OVTM.

20600 per working week 89267 per month 1071200 per annum These figures are approximate. The Georgia child support guidelines require that all. Georgia Overtime Calculator Tool To calculate your weekly overtime pay enter your normal hourly wage and the weekly number of hours you worked into the GA overtime calculator.

The overtime calculator uses the following formulae. B A OVWK. Employers also have to pay a matching 62 tax up to the wage limit.

The new guidelines which will be effective on January 1 2020 states the following principles. In addition employees in Georgia working over the 40 hours per week gain an. State and Federal Statutes.

Overtime pay per year. Georgia Salary Paycheck Calculator. Calculating overtime pay will vary depending on how you are compensated.

Georgias Overtime Minimum Wage Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. The overtime calculator automatically finds all the other values including the overtime pay regular pay and the sum which is the total pay the employee receives for the month. In Georgia if you receive overtime pay even sporadically it will be included in your income for purposes of a child support calculation.

Georgia Hourly Paycheck Calculator. Employees are split into two groups in regards to overtime pay with the critical factors being 1 how they are paid 2 how much they are paid and 3 what their job duties are. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

Georgia Minimum Wage Law GA Code 34-4-3. C B PAPR.

Overtime Calculator With Taxes Flash Sales 54 Off Www Ingeniovirtual Com

Georgia Child Support Calculator 2020 Georgia Food Stamps Help

Georgia Paycheck Calculator Smartasset

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Wage Theft Calculator Georgia Fair Labor Platform

Paycheck Calculator Take Home Pay Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Georgia Labor Laws Guide

Overtime Calculator With Taxes Flash Sales 54 Off Www Ingeniovirtual Com

Georgia Child Support Calculator 2020 Georgia Food Stamps Help

Overtime Calculator Gpetrium

Wage Theft Calculator Georgian Workers Report Over 21 Million Gel In Stolen Wages Annually Open Society Georgia Foundation

Georgia Paycheck Calculator Smartasset

Georgia Sales Reverse Sales Tax Calculator Dremploye

Overtime Calculator With Taxes Flash Sales 54 Off Www Ingeniovirtual Com

Overtime Calculator Gpetrium

Free Paycheck Calculator Hourly Salary Usa Dremployee